How the UAE is becoming a global crypto hub

A comprehensive regulatory overview of UAE ft. ADGM, VARA, DIFC, and RAKDAO and some insights on what founders should expect in the UAE.

We get a lot of inquiries from early-stage builders about navigating the UAE's crypto ecosystem; founders generally find that there is a lack of high-quality information. That’s why we wrote this article. We wrote it during the Superteam UAE Founders’ Trek, in which 20 Solana founders visited the major crypto regulators, free zones, and decision makers in the UAE.

The UAE has rapidly emerged as one of the premier destinations for cryptocurrency, owing to the user-friendly and straightforward regulations established by various emirates within the UAE. Leading crypto exchanges such as Binance, Coinbase, and Crypto.com have been drawn to the UAE, making it their global or regional hub.

This article summarizes everything you need to know about the UAE's cryptocurrency regulatory landscape.

UAE Overview:

As the pace of cryptocurrency adoption slows down in the Western world, the MENA (Middle East and North Africa) region is emerging as the 'dark horse' in the crypto sector. It now represents ~7.2% of the global transaction volume, with an estimated $389.8 billion in on-chain value received between July 2022 and June 2023, according to Chainalysis.

We can observe that the UAE and Saudi Arabia are emerging as significant hubs for cryptocurrency, with Dubai ranking as the third leading crypto city, trailing only New York City and Singapore. Several factors contribute to the UAE's rise as a key destination:

Regulatory Tailwinds: Unlike many jurisdictions that are tightening restrictions on crypto amidst regulatory ambiguity, the UAE's clear and well-defined regulations serve as a strong incentive to attract businesses and individuals. Additionally, the favorable business tax environment, currently at 0% in Free Zones, enhances its appeal.

High Wealth Concentration: The UAE ranks as the sixth-largest center for cross-border wealth management. Notably, both Dubai and Abu Dhabi are listed in Bloomberg’s Financial Centres Index 32.

Global Presence: The UAE has established itself as a major global trading hub, with Dubai emerging as the gateway city for the MENA region. Furthermore, the pegging of the AED to the US dollar at a rate of 1 USD = 3.6725 AED simplifies business transactions.

Personal Benefits: Individuals benefit from a 0% tax rate on crypto assets and personal income. To facilitate founders in relocating their operations, the UAE offers two relevant visas: a remote work visa (a renewable permit allowing one to live and work in the UAE based on income) and a golden visa (which requires proof of employment or investments in the UAE).

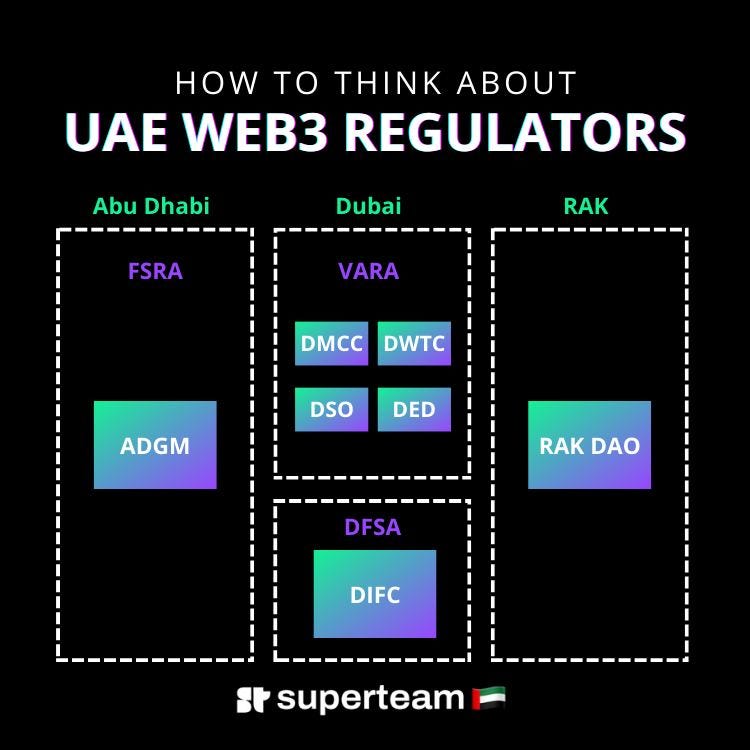

Regulations: Different Zones, Different Rules

Similar to how the US has varied legal regulations, the UAE also possesses distinct regulations, not only by states but also across various 'economic zones'. In the UAE, there are three primary types of zones:

Mainland Zones, such as ADED (Abu Dhabi Department of Economic Development), are designed for regular local businesses.

Free Zones, including DMCC, IFZA, and RAKDAO, permit 100% foreign ownership. Dubai alone boasts over 20 free zones, while the UAE collectively has more than 35.

Financial Free Zones, like DIFC & ADGM.

If we divide geographically by emirate, here are the major zones focussed on Crypto:

Dubai — DMCC and DIFC

Abu Dhabi — ADGM

Ras Al Khaimah — RAKDAO

Each zone has different regulations; we will talk about them one by one and discuss only major points:

VARA — Dubai’s Crypto Laws

The Virtual Assets Regulatory Authority (VARA) serves as the exclusive authority regulating virtual assets throughout Dubai’s free zones and the mainland, with the exception of the Dubai International Financial Centre (DIFC). VARA is currently regarded as the foremost regulator in the UAE.

Earlier, there were four stages of approval in order to launch a business: Temporary Approval → Preliminary Approval → Minimum Viable Product (MVP) Approval → Full Market Product (FMP) Approval. With the latest regime, there is an initial approval → Internal MVP Approval → Full Market Product (FMP) Approval.

All crypto companies that are subject to VARA (Virtual Assets Regulatory Authority) regulations are known as VASPs (Virtual Asset Service Providers). To provide an overview of the various categories, the following are examples of active entities being regulated under VARA:

Investment Services: Laser Digital

Exchange: Binance, TOKO

BitOasis, a leading exchange in the UAE, once held a license, but VARA (Virtual Assets Regulatory Authority) suspended it due to unfulfilled requirements, sending a clear message about the consequences of non-compliance. Major firms such as Bybit, OKX, Crypto.com, and GCEX are also contenders, but their applications are currently pending.

Pros of VARA — Responsiveness: VARA's responsiveness is evident from its swift amendment in response to industry demands, such as allowing custodians to stake assets from custody. This agility enables businesses to innovate rapidly.

Cons of VARA — High Barriers to Entry: Although beneficial for risk management, these barriers pose challenges for early-stage startups. Most firms that are in the advanced stages of obtaining licenses are already established entities.

In summary, while VARA's processes are time-consuming and thorough, they offer comprehensive and clear regulations — further details about VARA are available for those interested in learning more.

DMCC (Under VARA)

One of the most crypto-friendly free zones following VARA regulations is — DMCC (Dubai Multi Commodities Centre), where most of the crypto companies (500+) have set up their bases. They have a dedicated ‘Crypto Centre’, where they keep organizing hackathons (eg, one with ByBit) and partner with ecosystems like Solana.

DFSA - DIFC’s Crypto Regulator

The DFSA (Dubai Financial Services Authority) is the independent regulator of financial services conducted within or from the DIFC (Dubai International Financial Centre), a purpose-built financial free zone in Dubai. It's important to note that although the DIFC is located in Dubai, VARA laws do not apply there; instead, it operates under its own laws as established by the DFSA.

As one of the most prestigious financial regulators and top-rated financial centers in the Middle East, the DIFC is the chosen headquarters for many global financial houses. It hosts various crypto and fintech companies, including Ripple, SoFi, TRM, Adyen, and Darwinbox (note that they aren’t regulated by DFSA — either they are in sandbox or applied for crypto token recognition).

ADGM — Abu Dhabi’s Crypto Laws

In 2018, the ADGM (Abu Dhabi Global Market) established the world's first regulatory framework for cryptocurrencies, aiming to position the UAE as a leader in this field. Since then, this framework has evolved and developed into a comprehensive structure. It clearly categorizes digital assets, with each category having its own defined characteristics and requirements.

Two key specific activities attract higher regulatory requirements, namely:

Exchanges — Operating a Virtual Asset Multilateral Trading Facility

Custodian, Broker-dealer, Asset manager, and Advisory

Some of the firms licensed by ADGM as Financial Services Permission (FSP) offering trading services are: Matrix, MidChains, SEBA Bank, Havyn, and Changer.ae Ltd, M2, Binance, Nomura’s Laser Digital, Rain.

Read more about ADGM here.

RAKDAO:

Launched on October 19, 2023, Ras Al Khaimah Digital Assets Oasis (RAKDAO) is also a free zone by one of the emirates of UAE, focussed on digital assets. It’s the 6th largest city located a few kilometers from Dubai, offering an offbeat alternative to Dubai and Abu Dhabi. To compete with other free zones, they are also offering various packages like Freelance Permit, Remote Company (No need for physical office), and Standard Company at competitive rates. While the rules and regulations are still nascent, it’s definitely worth checking out.

Practical Advice for Founders to Get Started:

Getting Incorporated — All zones in the UAE have established clear regulations. It's crucial to partner with trusted local ecosystem partners like Harbour, as there is a notable prevalence of scams. It's important to note that the current costs of setting up a company in any free zone are higher than in other jurisdictions like the US or Singapore, ranging from $5,000 to $25,000. You can request referrals to trusted service providers by completing this form.

Team Building and Talent — Due to the large populations of nearby South Asian countries like India, the UAE has easy access to expatriate talent. The combination of an easy visa process, tax-free status (0% personal income tax), and a high standard of living can attract talent from around the world.

Raising Funds and Market Making — In addition to global venture capitalists (VCs), the UAE boasts a variety of government-backed investment entities like the Abu Dhabi Investment Authority (ADIA), ADQ, Mubadala, and IDO. Apart from supporting DeFi projects and exchanges, the UAE has a regional presence of various market makers such as GSR, DWF Labs, and CLS Global. For an overview of UAE-based crypto investors, refer to our previously written article.

Focus on Institutional Use-cases — According to Chainalysis, more than 67% of all crypto transactions were institutional in nature (transactions over $1 million), while retail transactions constituted less than 5%, highlighting the region's strong institutional focus. Additionally, although the UAE has a limited retail population (less than 10 million), it holds approximately $500 billion in investable wealth from non-UAE citizens, indicating a robust investment appetite. The regulators have also been increasingly focusing on institutional use cases.

Closing Thoughts:

Located at the crossroads of Europe, Asia, and Africa, the UAE is ideally positioned as a gateway for companies looking to expand into these regions. The city's strategic geographic location, global reputation, robust infrastructure, and strong government support make it an attractive destination for international investors. Dubai offers a compelling proposition for businesses with its sound legal framework and business-friendly tax environment, providing an ideal setting for growth-oriented enterprises.

In contrast to other jurisdictions where companies are actively seeking crypto regulations, Dubai's focus on the digital asset market appears to be primarily government-driven, stemming from its structural necessity to explore new avenues for growth — indicating a positive long-term outlook.

While the license requirements in UAE zones are relatively straightforward, the approval process can be complex. This complexity underscores the importance of maintaining close relationships with the UAE government and local entities. A notable advantage is that Superteam UAE has established connections with almost all the key players mentioned above.

If you are a founder looking to build out of UAE or just have any questions, follow Superteam UAE: https://twitter.com/superteamAE

Special thanks to Soham Panchamiya, a reputed tech lawyer in UAE for helping us with editing the key parts — for further queries, do reach out to him.

Habibi, come to Dubai! 🇦🇪